The average price of property coming to the market jumped by 1.8% (+£6,647) this month to reach a new record of £372,894 in a delayed response to the higher-than-expected level of market activity since the start of the year. This could be due to a number of reasons, including increased confidence in the mortgage market with the introduction of the Skipton Building Society of a zero per cent deposit and rates being favourable in comparison to last year at an average 5-year fixed, 15% deposit mortgage is now 4.56%, compared to 5.89% last October.

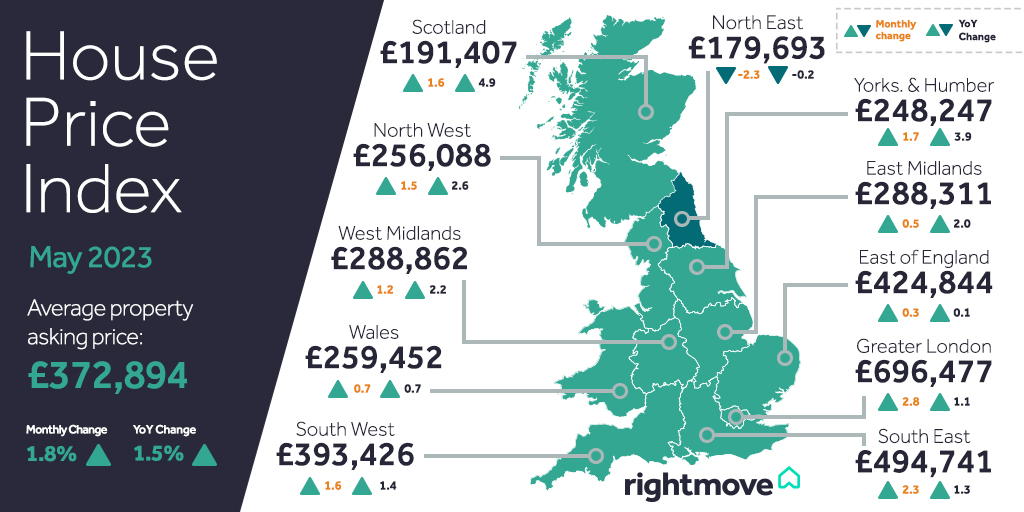

Focusing more locally, in the northeast, prices are down 2.3%, which is out of kilter with the rest of the country where there has been a modest increase, but year on year, the fall is only 0.2% which is negligible, and nowhere near the fall that was speculated in the press. While the market remains more price sensitive than it has been, well priced homes are attracting good interest from buyers, while those which are pitched more ambitiously to start with, may chase the market more so than more motivated sellers, which is more in line with the return to normality we have predicted.

Key stats

- The average price of property coming to the market jumps by 1.8% (+£6,647) this month to reach a new record of £372,894 in a delayed response to the higher-than-expected level of market activity since the start of the year:

- This 1.8% monthly increase is the biggest of the year so far and is significantly higher than the historic average May rise of 1.0%

- Agreed sales numbers are currently just 3% behind the last more normal pre-pandemic market of 2019

- The discount from the final asking price to the agreed sale price has steadied at an average of 3.1%, in line with normal market levels, reflecting home-mover confidence in the outlook for the market

- Whilst increased price confidence appears to be more justified in the lower and middle market sectors, there are some signs of over-optimism in the top-of-the-ladder sector, as some discretionary buyers hang back:

- Buyer demand is 1% lower than in 2019 for top-of-the-ladder properties, compared with 3% above 2019’s level in the second-stepper sector, and 6% above in the first-time-buyer sector

- Average mortgage rates are remaining steady despite another increase in the Bank of England base rate:

- An average 5-year fixed, 15% deposit mortgage is now 4.56%, compared to 5.89% last October